The 2026 Mortgage “Cliff” is a Myth: Why Your Renewal Won’t Bankrupt You

If you bought a home in 2020 or 2021 with a rock-bottom interest rate of 2%, looking at your mortgage statement right now probably feels pretty scary.

You see the date “2026” looming. You see the headlines about a “Mortgage Renewal Cliff.” And you’re doing the mental math—wondering if your payment is going to double.

I want you to take a deep breath.

I talk to homeowners in London every single day who are losing sleep over this. But here is the truth: The “Cliff” is actually just a slope, and it’s a lot easier to climb than you think.

Here is the reality of the 2026 renewal market, and the specific plan you need to protect your wallet.

Why the media’s “Mortgage Cliff” headlines are misleading

Bad news gets clicks. Telling you that “everything is going to be fine” doesn’t sell newspapers. So, you see headlines about rates skyrocketing to 5% or 6%.

But the bond market—which actually dictates fixed mortgage rates—is telling a different story. The economy is slowing down, and inflation is cooling. That means mortgage rates are already coming down. While you might not get 1.99% again, you also aren’t going to be forced into 6%. The gap is narrowing every month.

The real interest rates available to you right now

If you walked into a bank today, the posted rate might look high. But that’s the “sticker price.” Nobody pays sticker price.

Right now, we are seeing 5-year insured fixed rates hovering around 3.69% to 3.99% for qualified buyers.

Here’s what that looks like on a $400,000 mortgage:

- At 2.0%: Payment is ~$1,695/month.

- At 3.7%: Payment is ~$2,035/month.

Is that an increase? Yes. It’s about $340 more a month. That is real money. But it isn’t a bankruptcy-level event for most families. It is manageable—if you have a plan.

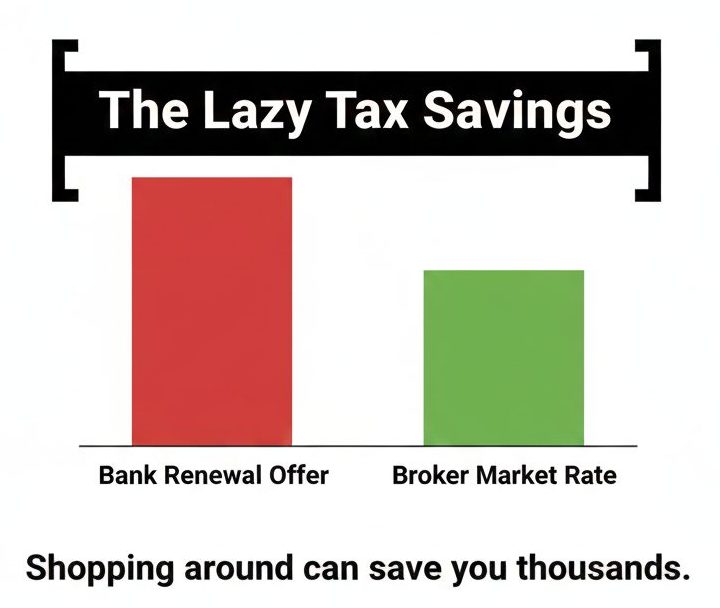

Why simply signing your bank’s renewal letter is the single most expensive mistake you can make

About 90 days before your renewal, your current lender will mail you a letter. It will say: “Good news! We’ve pre-approved your renewal. Just check this box, sign here, and you’re done.”

Do not sign that letter.

Lenders bank on the fact that you are too busy or too stressed to shop around. They often offer you a rate that is 0.25% to 0.50% higher than what you could get on the open market because they know switching feels like a hassle.

But here is the good news: New government rules mean you no longer have to re-qualify or pass the “Stress Test” just to switch lenders.

In the past, you were stuck with your bank because switching meant proving you could afford a rate of 7% or 8%. That rule is gone for straight renewals. You are now free agents. You can leave your bank and take a better deal down the street without jumping through hoops.

We advise all our clients to shop around (No Cost, No Obligation)

You don’t have to fight the bank alone. In fact, we advise every single one of our clients to speak with an independent mortgage broker before they sign anything.

Unlike a bank employee who can only sell you their bank’s products, a broker works for you. They can shop your mortgage to dozens of lenders to find the absolute best rate and terms.

The best part? It is almost always no cost and no obligation to you. The lender pays the broker, not you.

If you don’t have a broker you trust, we are happy to help. We have a short list of trusted local brokers who we use personally and have referred to dozens of happy clients. If you want a second opinion on your renewal offer, just reach out. We can connect you with someone who will give you the honest truth about your numbers.

The specific math on “Right-Sizing”

Sometimes, even the best rate doesn’t fix the budget. If your life has changed—maybe the kids have moved out, or you want more travel money—2026 might be the perfect time to “Right-Size.”

By selling your current home and moving to a smaller property or a different area, you might be able to take your equity and wipe out your mortgage entirely. Imagine heading into 2026 with zero payments.

If you are curious about what that looks like, we can help you run the numbers. There is no cost and no obligation. Our goal is simply to help you get all the options so you can make an educated decision for your family.

Want to know where you stand?

- Text your address to 226-271-1140, and we’ll start the analysis for you.

- We’ll give you a quick call to ask a few questions about your home’s condition, and then send you a clear report on your potential equity.

Don’t let fear make your decisions. Let the math make them.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link